The Arctic and Natural Gas in Northeast Asia’s Energy Future

July 6, 2012

Countering Chinese Cyber Operations: Opportunities and Challenges for U.S. Interests

October 29, 2012In mid-July, Vietnam announced that it would extend the contract of India’s ONGC Videsh Ltd. (OVL) –the international arm of India’s Oil and Natural Gas Company (ONGC)–for block 128, which lies in Vietnam’s exclusive economic zone (EEZ) in the South China Sea.  After initial exploration, OVL had concluded that development of the block within the time limits of the original contract would be economically unfeasible. Yet, Vietnam’s new offer extended the development timeline and added data that would reportedly make development more efficient. OVL accepted the offer four days later.  Hanoi’s decision to extend the contract comes in the wake of the underwhelming July conference of the Association of Southeast Asian Nations (ASEAN) in Cambodia, which failed to produce a communiqué, much less a Code of Conduct delineating acceptable practices in the South China Sea. The offer signals Hanoi’s wish to keep an Indian presence in the South China Sea to balance China’s assertive behavior. At the same time, OVL’s economic relationship with Vietnam highlights the expansion of India’s Look East Policy, wherein India’s strategic goals are furthered by the presence of legitimate economic development in the South China Sea.

India’s growing engagement with Vietnam, and by extension in the South China Sea, is a logical expansion of its Look East Policy (LEP). The policy was first initiated under then Premier P.V. Narasimha Rao during a visit to South Korea in 1993. While in Korea, Premier Rao called for economic liberalization and an “opening in the floodgates†to South Korean chaebols (mega corporations). Just months after the visit, Daewoo automobile was successfully launched in India.  Beginning in earnest at the start of the 21st century, the geographic scope of India’s LEP extended downward to Southeast Asia and the Pacific. In the process, India appears to be asserting a strategy that combines economic, political, and security leverages in the Asia-Pacific. The comprehensive nature of this policy has enabled the economic activities of India’s private and state-owned companies to be in line with New Delhi’s expanding diplomatic relations with the region. Most recently, the policy manifests itself in efforts by private and state-owned Indian companies and the Indian Navy to actively develop ties with ASEAN countries bordering the South China Sea.

The evolution of New Delhi’s LEP to involve ASEAN reflects the increasing geostrategic importance of the South China Sea. India is not a South China Sea littoral state and has no territorial claims in the region. However, the stability and freedom of navigation in the South China Sea are vital interests for New Delhi– fifty-five percent of India’s trade with Asia passes through this strategic sea route, including crucial energy supplies.  The South China Sea is an economic security lifeline for India and New Delhi relies heavily on the United States and ASEAN partners for cooperation in protecting shared interests in the region. The strategic relationships built with ASEAN nations were even acknowledged by an editorial in the China-based Global Times as paramount to India’s national security. Conversely, the success of India’s strategy is equally important for Vietnam. Potential economic benefits aside, OVL’s presence in the South China Sea and effort towards joint development of block 128 present Vietnam with international credibility over the disputed economic zone.

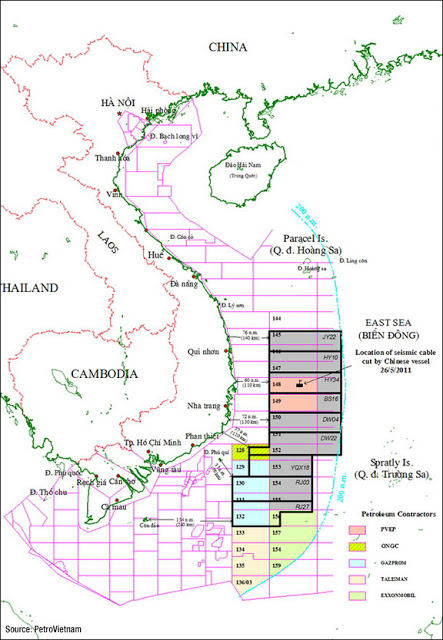

Apparently in reaction to Vietnam’s decision to extend OVL exploration off its coast, China’s National Offshore Oil Corp. (CNOOC) announced on June 25, 2012 that it would accept bids from foreign oil companies to jointly develop nine blocks (JY22, HY10, HY34, BS16, DW04, DW22, YQX18, RJ00, RJ27) in the South China Sea, including areas that overlap with blocks that Vietnam has already started jointly exploring and developing with India’s OVL, the United States’ ExxonMobil, and Russia’s Gazprom.  CNOOC blocks HY34 and BS16 overlap with Vietnam blocks 148 and 149, which belong to PetroVietnam Exploration and Production Company (PVEP). CNOOC blocks RJ27, RJ03, YQX18, and DW22 overlaps blocks belonging to ONGC, Gazprom, and Exxon, who among themselves are developing Vietnam blocks 128-132 and 156-159. Chinese state media reported a month after the initial offer that the CNOOC tender is progressing smoothly, and claims several U.S. oil and gas companies have submitted offers, but declined to give any specific information about foreign participators.

The latest flare up in tensions in the South China Sea, underscored by China’s reaction to India’s energy diplomacy with Vietnam, is illustrative of the frail state of the South China Sea dispute. To be sure, China perceives any actions that encroach upon what it considers Chinese sovereign territory as unacceptable, and therefore India’s warming relations with ASEAN countries as a hedge against its claim in the South China Sea. The almost-universal acknowledgement of the United Nations Convention on the Law of the Sea (UNCLOS) as international law and the upward trajectory of Indo-ASEAN relations may set a solid precedent for the peaceful and non-military resolution of future disputes by reinforcing the role of non-littoral states in the South China Sea. Yet, energy disputes such as this one reflect the disjointed state of the South China Sea dispute. While regional peace and stability may be the cited goal of both India and China, the shadow of intolerance that China casts over energy diplomacy will continue to define the potential paths to conflict resolution in the South China Sea.