Why is Beijing Arming to the Teeth?

December 4, 2018

The Nightmare Scenario: The PLA Invasion Threat & Taiwan’s Response

December 6, 2018By: Jasmina Buresch |

Q&A with Andrew Small

Unveiled by Chinese President Xi Jinping in 2013, the Belt and Road Initiative (BRI) is a trans-continental connectivity undertaking that aims to facilitate greater trade, investment, and the exchange of technology and expertise between China and the other 84 countries involved. For China, successful BRI implementation in Europe brings obvious benefits: faster shipping routes for Chinese goods to Europe, the use of China’s over-capacity reserves to build infrastructure abroad, and the relocation of production facilities to low-cost Central and Eastern European countries. Furthermore, the European Union (EU) is China’s largest trading partner and leading source of foreign investment. Europe’s relation to Asia as a whole is similarly significant, as 35% of European total exports are sold to Asia, and four of Europe’s top ten trading partners are in Asia, with China as the second largest. It is in Europe’s interest to maintain unhindered trade flows to Asia and ensure China remains a reliable partner through the promotion of good governance principles within its processes. The Belt and Road Initiative has the potential to boost infrastructure in less-developed European nations and increase the efficiency of trade routes. However, China’s ambiguous intentions and lack of transparency have caused many European officials to have second thoughts.

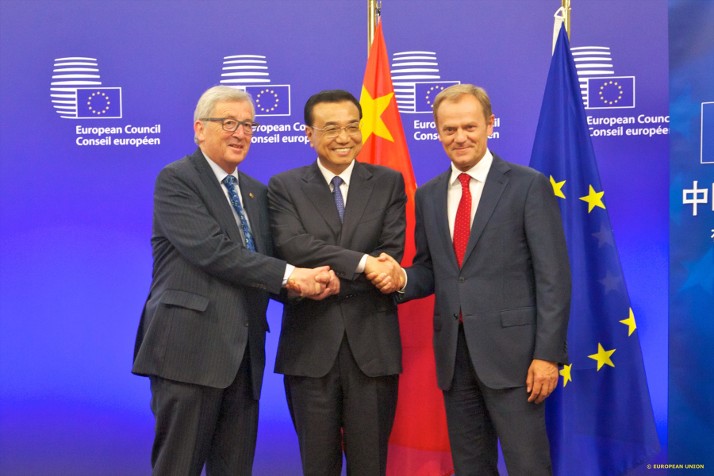

The Project 2049 Institute and Andrew Small, senior fellow at the German Marshall Fund’s Asia Program, discussed China-European relations and the current standing of the Belt and Road Initiative in Europe.

How would the advancement of the Belt and Road Initiative (BRI) throughout Europe affect China and European member states’ respective national capabilities?

The BRI’s effect depends entirely on how it’s conducted. Within the EU, there are robust standards in place, meaning any practices that don’t adhere to single market rules, on public procurement for instance, are prohibited. This means that the sort of behavior we’ve seen elsewhere along the BRI, where financing is tied to contracts for Chinese companies, cannot take place. Among different EU member states, there are significantly varied attitudes to the kinds of investments that are being sought from China and very different levels of openness to FDI more broadly. But explicitly BRI-linked investments in Europe have been relatively modest in scale. The period that saw the biggest Chinese infrastructure investments in Europe was tied to the eurozone sovereign debt crisis from 2010 to 2012, rather than the BRI, and the bulk of Chinese investments in recent years have been acquisitions in the major western European economies. Most of the cases of economic coercion or Chinese political influence have been unrelated to the BRI too. There simply isn’t much of a track record of Chinese infrastructure investments in Central and Eastern European (CEE) member states, for instance—somewhat to their frustration.

This may start to change. Ever since the BRI was announced in 2013, the European side has been pushing the Chinese to integrate the initiative with existing European schemes and financing mechanisms. These efforts have been slow going, though there was some progress at the last EU-China summit. The tone in Europe hasn’t shifted—I would characterize it as “open in principle, skeptical in practiceâ€â€”but Beijing has shown greater willingness to move on European asks in recent months. The Europeans’ goal, though, is a version of the BRI that works on European terms, not investments that would undermine the financial situation of member states or compromise their political choices. If they can’t achieve that, the scale of BRI investments in the EU will remain limited.

It is a different story for non-EU members, where you see problematic developments of a familiar kind: the spike in Montenegrin debt resulting from a questionable Chinese-built highway project, and the equally dubious Belgrade-Budapest high-speed rail line, which the Serbian government essentially supported as quid pro quo for China saving its bankrupt steel industry. Without wanting to underplay the significance of these examples, though, the big prize for states in the Western Balkans remains EU accession, and there remain real limits to how far China’s economic presence is likely to advance.

Hungary, which is known to welcome significant amounts of Chinese investment, was the only EU member out of 28 to refuse to sign on to a report ahead of the July 2018 EU-China Summit, which denounced the Belt and Road Initiative for obstructing free trade and giving an advantage to Chinese companies. How great is China’s political influence that accompanies the BRI’s infrastructure investment in Europe? Can China’s strong economic relations to CEE countries be used to pressure individual member states and create divides impacting Europe’s (or the EU’s) cohesion?

The linkage between BRI and Chinese political influence can be exaggerated—there are other countries with more significant levels of Chinese investment that have not behaved in the same manner as Hungary, or Greece for that matter. The problem cases are typically those in which China takes advantage of existing tensions between EU member states, such as with both Budapest and Athens, rather than Chinese money translating directly into leverage. One of the main reasons for this limitation is that Chinese financing is still dwarfed by the economic firepower of the EU in these CEE countries. Investment from Beijing certainly provides a top-up and a boost to the narrative of states that want to claim that they’re building more autonomy for themselves from Brussels and western Europe.  However, Chinese investment is still a pittance in comparison to EU structural and investment funds in the region, and the Chinese terms of investment are markedly worse than the European Investment Bank (EIB). Hungary is making its own political choices: its behavior is not primarily attributable to Chinese economic pressure.

It’s also important to note that we are talking about, at most, a handful or countries, typically one or two. While these cases certainly make a difference on issues where unanimity is required, broader divides do not necessarily characterize the general direction of EU-China policy; we often see a consensus plus a spoiler or two. In practice, the EU has been able to toughen up its approach to China considerably in other areas, such as trade policy, in recent years.  None of this is to say that there isn’t an issue with European countries treading gingerly around China on certain issues in the hope of ensuring a better relationship―you only need to look at the Dalai Lama’s shrinking political space in Europe—but such behavior predates the BRI. Equally, there are clearly differing views on China across the EU, but excessive emphasis on these “splits†can be a distraction from the fact that the European Union is often able to reach agreement on important China-related decisions, and that the direction of movement in Europe has generally been towards a hardening of China policy.

In June, U.S. Secretary of State Mike Pompeo characterized China’s trade practices as “predatory economics.” Similarly, during his visit to China on January 4th, French President Emmanuel Macron expressed that the Belt and Road Initiative could not be “one-way,†and admitted concern that Beijing is limiting French companies’ market access. What risks do BRI projects pose to the security and the stability of European companies? Is China engaging in predatory economics in Europe? If so, can you share an example?

There are longstanding economic issues between the two sides that largely resemble the problems that the United States has with China. That is, the EU lacks access to Chinese markets in sectors where China has relatively uninhibited access on the European side. Chinese companies benefit from significant subsidies, stolen technologies, and forced technology transfers. Furthermore, there are sectors in which massive Chinese overcapacity has hit European producers. And all these problems grow more acute as Chinese companies start to compete in more and more advanced sectors, for example, taking over European chemical makers at inflated prices, bidding for high-speed rail contracts in Europe, or acquiring robotics and semiconductor companies, not to mention what has already played out in areas such as telecoms. Whether this is a function of predatory practices intentionally aimed at damaging foreign competitors or simply the behavior of a state-dominated actor operating in a trading system that is not well set up to deal with a non-market economy of China’s scale, it’s extremely problematic for European competitiveness.

The BRI essentially extends the problem to third countries, as China is able to exclude European companies from opportunities in order to win contracts, set standards that will privilege Chinese companies, and saddle governments with unsustainable debts. There are aspects of fair competition too: China has world-class companies in certain sectors which benefit from economies of scale in their own market and are adept at operating in the developing world. Nonetheless, Europe is increasingly facing its usual bilateral headaches with China in other markets, such as issues relating to restrictive procurement practices and state subsidies. These specific areas of contention are where much of the European BRI pushback is directed, rather than BRI investments in the EU itself. There are, however, growing European sensitivities around inbound Chinese investment more broadly. The toughening up of review processes in Germany, France, and the UK, as well as the new EU mechanism, are partly concerned with critical infrastructure, notably telecoms and ports. As in the United States, though, there is even more European concern directed at Chinese activities in the high-technology sector, highlighted by the “Made in China 2025†strategy, than the BRI connectivity projects.

The recent EU-China summit was lauded as a success. Along with affirming each side’s commitment to a rules-based, transparent, open, and inclusive multilateral trading system, a Memorandum of Understanding between the European Investment Fund (EIF) and China’s Silk Road Fund (SRF) was signed to establish the China-EU Co-Investment Fund (CECIF). What are the EIF’s and SRF’s current roles in the Belt and Road Initiative, and how will the establishment of the CECIF change the dynamics of the Initiative’s funding and processes?

The EU has consistently said to China that if it wants to invest in pan-European infrastructure, there is already a scheme in place by which it can do so: the so-called “Juncker plan†for strategic investments. China was open to this plan as long as it could ensure finances would be directed to Chinese firms. The European side explained that this was not possible under EU rules. We now seem to have a resolution of sorts. Rather than direct funding for the EIF, with zero Chinese influence over the results, there will be an EIF-backed co-funding program, with one of the key Chinese BRI financing bodies, the Silk Road Fund, working alongside the EIB. The EU-China summit also saw an agreement for the two sides to look at financing a specific list of potential projects in Europe and China, including some quite prominent ones. It appears, in both cases, to be progress towards the EU being able to secure Chinese financing on terms that adhere to European standards, both for large infrastructure projects and for the sort of small and medium-sized enterprise support that is envisaged under the co-investment fund. We will have to see how this development plays out in practice, but the co-investment fund largely resolves what the European side has been pushing for in this specific area over the last few years.

In your opinion, do you see the Belt and Road Initiative as win-win for the EU? In an interview by World Politics Review last year, you mentioned that the EU has made efforts to engage with Beijing to mitigate risks related to environmental and social standards, debt, and corruption problems. A year later, have they been successful? Why or why not?Â

We are heading into a slightly different phase of the Belt and Road Initiative now. China is looking to find ways to cooperate with a variety of major partners that have been skeptical about the BRI so far. Aside from Europe, you see it with Japan and, in a more modest way, with India too. There is little question that Beijing will still want to maintain the prerogative to pursue the same kind of problematic bilateral deals with countries that we’ve seen since the BRI launched. But for the political image of the initiative―and even just for the sake of financial risk management― I would expect there to be an increase in the number of projects that adhere to higher standards and that draw in additional outside parties. It has certainly made a difference to Chinese behavior that the EU and major member states― including France, Germany and the UK― have refused to grant political endorsement to the initiative if it fails to match the required norms on transparency, corruption, sustainability and so on, which is a collective stand that has been taken by a number of other advanced economies too. High-profile embarrassments in various developing countries, and contentious relations with newly-elected governments there, have had an impact too. And even more important than the European position on the BRI or the backlash in parts of the developing world is the fact that Beijing is trying to shore up and stabilize its relations with other major powers as tensions with the United States intensify. While China isn’t going to undertake a fundamental reorientation of the BRI to take others’ concerns into account, a rebalancing of their positioning may be expected.

The EU has been developing its own strategy for connectivity in the region, titled “Euro-Asian Connectivity.” In regards to its implementation, what are the challenges this strategy will face vis-à -vis BRI projects? To that end, are Europe and China compatible partners in terms of their respective political systems, markets, and values?

The EU’s strategy for connecting Europe and Asia should be seen in the context of a number of new initiatives: Japan’s Quality Infrastructure Initiative, the commercial dimensions of the U.S. Free and Open Indo-Pacific (FOIP) Strategy, as well as the efforts from India, Australia, and others. While each of the schemes has its own specific priorities, the BRI has clearly catalyzed a push from an assortment of actors to improve their alternative offers and to ensure that countries have a range of options to choose from. With the exception of Japan, no-one is mobilizing significant new public resources, but a more strategic marshaling of the substantial existing financing streams, and efforts to reduce risk and improve returns for private-sector actors, will make a big difference. These BRI alternatives are all going to be far more contingent on market decisions than the Chinese approach but that doesn’t mean that the numbers will be any less significant. The EU, for instance, has recently been able to leverage as much as €500 billion of new private-sector infrastructure investment in the EU itself, through the Juncker Plan, and expects to be able to replicate this outside the EU’s borders with the new strategy. Hence, although there are seemingly dispiriting comparisons drawn between trillions of dollars of supposed Chinese funding and the limited pots that various democracies are offering, in practice the EU and Japan are already both larger investors in, for instance, ASEAN than China, though Beijing is certainly catching up. Meanwhile, in Europe’s periphery, the relative weight is vastly in the EU’s favor, even if you only take into account public rather than private sector figures.

The challenge that the EU strategy will face, along with others involved in the BRI, is less that of the total resources deployed and more that there are countries that find Chinese financing attractive precisely because it is not “high-standard.†Beijing’s offer of quick-turnaround, politically-directed lending is often an appealing contrast to the more rigorous conditions that the EU and other investors demand. In most cases, states will want a balance: they don’t want excessive dependency on China either, nor projects that ultimately prove economically unviable. The dynamics that we’ve been seeing from Malaysia to Sri Lanka reflect the political reappraisal of Chinese infrastructure investments that is underway. Nonetheless, if China fixes some of the most egregious problems that we saw from the BRI in its first phase, it may actually prove to be an even more effective competitor. Investments will still be based on a fast-moving, total-system approach where state and private companies alike can be readily aligned with political and security objectives. If China makes some moves towards improving transparency, prioritizes stronger local and international partnerships on projects, improves the terms of its loans, restructures some of the existing debt, and so on—even in just a few high-profile cases—it will still be able to reap a lot of the benefits without the scale of criticism it has attracted to date.

On a project-by-project basis, there is no intrinsic reason why China can’t be a partner for the EU as long as it adheres to acceptable standards, such as those adhered to by the Asian Infrastructure Investment Bank (AIIB). However, there are more fundamental questions at the moment, not so much about whether the two sides can work together on financing a port project or a railway line, but rather how China and the advanced market economies should interact with each other across the board: trade, investment, science, technology, education, and other areas. You don’t have the same sweeping debates about the “decoupling†and “disentanglement†of economic ties with China in Europe as you have in the United States, but many of the driving questions are similar: In what areas should the EU demand reciprocity? Can the World Trade Organization (WTO) be reformed or will China-related problems test the system to its breaking point? Is it possible to exert sufficient pressure for structural economic change in China or will we have to expand efforts to construct a new high-standard trading club that excludes China? Which, if any, Chinese investors should be treated as independent actors and which as part of a unified party-state system? What should the new limits of access for Chinese investment be, and how far should this be decided on the basis of “economic security†rather than just “national security� What are the implications for European competitiveness, security, and the everyday life of European citizens if China achieves a leadership position in various new technologies?

Evidently the European and U.S. debates are not identical: there is a less acute sense of rivalry with China in Europe than in U.S. policy circles, and there is a far greater European emphasis on preserving the multilateral system. As a result, I suspect the Europeans will look to strike a somewhat different balance in its dealings with Beijing, its approach to the fate of the WTO, and the outcomes of the BRI. Nonetheless, most European concerns are closely shared with the United States and there is clearly a complementary agenda that the two sides can pursue: cooperation and coordination between the FOIP strategy and the Europe-Asia connectivity strategy being an obvious starting point.Â

Jasmina Buresch is a former Intern at the Project 2049 Institute. She is currently an undergraduate at Fordham University majoring in International Political Economy (IPE). Jasmina is fluent in Bulgarian and is studying both Arabic and German.